Lovable makes $75m in 7 months—but is it nailing pricing?

The current (and future) monetization strategies of "Shopify for SaaS"

“I remember we were building a micro-app like that and it took at least a month, now it takes 3 minutes.” I messaged a colleague after trying out Lovable and sharing what I (it?) made.

“It’s truly shocking” he responded.

Using Lovable for the first time was like taking my first Waymo ride. At first, it was mind-blowing (I had no idea this was possible!) and then unremarkable (yep, that v1 works like a v1, as if I handed it to an engineer).

Vibe-coding is one of the trending topics in tech. Investors, founders and non-technical people showed off their vibe-coded creations. A fellow non-technical muggle at my co-working space told me he cancelled his Spanish-learning subscription because he’d built his own learning app in 10 minutes.

I, too, realized the upside of finally building my own apps and made the following:

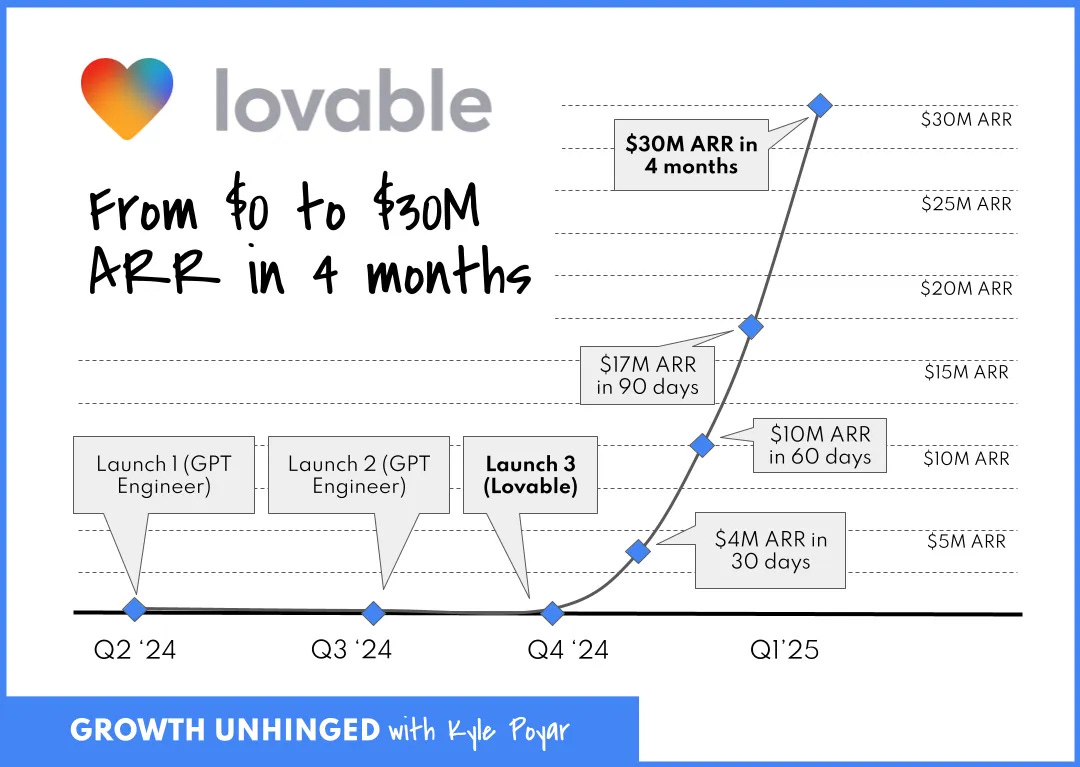

Just kidding, but vibe-coding put Stockholm-based Lovable in the spotlight. Europe’s fastest-growing startup. It reached $75m ARR in 7 months (and adds millions more each week). And it’s doing all that with only about 35 people. Founder Anton Osika made the podcast rounds proclaiming a bold mission: Lovable is building the last piece of software.

With an estimated global SaaS spend of $300-$400B, building the software that can build all other software begs a question: How much should the last piece of software cost? What price is right for the tool that builds any other tool? How do you monetize something so monumental?

To figure this out, I spoke with Lovable’s Head of Growth

. What follows is a mix of insights from my own research and my interview with her.There’s enough analysis of Lovable’s growth out there, but I wanted to dive into Lovable’s pricing and monetization, evaluate what it gets right, what could be improved and what they might want in the future.

Evaluating this is quite hard because the point here isn’t whether Lovable should cost $25 a month or $35 a month. To figure out how to monetize something, you need to ask a simple, but hard to answer question: How does Lovable create value?

How Lovable creates value (and how it doesn’t)

For some AI tools, the value is obvious. Cursor boosts engineers productivity. So if you’re paying an engineer $100k/yr, pay Cursor $480/yr to make them 20% more productive, you’re buying $20k of productivity for less than $500. Contract signed, thank you very much.

For Lovable, defining the value is harder because it’s so new. You could never before type an English sentence and get a functioning app. While that magic is obviously valuable, it’s not easy to say why.

So let’s look into a few ways Lovable might be creating value.

Productivity boost in existing workflows

The reason Cursor’s value is easy to define is because it maps to existing workflows, i.e. engineers coding in an IDE. It improves that workflow and creates value that way.

(there are always second-order effects, like requiring fewer engineers because the existing ones are more productive)

For Lovable, the only perfectly matching workflows would be building simple software, like MVP (minimum viable product) development or niche SaaS.

For MVP development, a founder wants to validate an idea, a product manager wants explorations or an agency serving its clients can now collapse the time from idea to prototype from weeks to minutes. Same goes for independent founders building niche apps that shine because they’re custom to a use case, not because they attract enterprise customers.

Lovable is perfect here because these ventures rarely require the complexity that AI coding still struggles with: Multi-product complexity, microservice jungle, enterprise features like SSO, SAML, RBAC, etc.

Lovable is perfect for this because it accelerates what’s already being done.

The problem is that MVPs are designed to be obviated. You test the waters with an MVP before you build the real thing. This leads to the biggest criticism of Lovable: It will suffer from high churn because it doesn’t create anything you keep using.

Because to charge customers on an ongoing basis, you need to provide ongoing value.

The “easy” thing for Lovable would be to focus on agencies and product managers who repeatedly prototype software—the segments that are actually likely to retain. But wouldn’t satisfy Lovable’s ambition to build the last piece of software.

But this scenario assumes Lovable is a finished product and no longer evolving. The naysayers who claim everyone will churn are like saying Shopify customers will move on to “real” businesses with SAP and custom e-commerce software.

So where else can they generate value? As the product and its underlying technologies evolve, we’ll see new ways of generating Value for companies like Lovable. In fact, I think the opportunity is so big, it’ll unleash a wave of entrepreneurship, just like a $134B company.

Lovable is Shopify for SaaS

Lovable is like a Shopify that designs, manufactures and stores an infinite supply of a SaaS product. This makes it easier than ever to start a software business. That is the real value of Lovable.

If, like Shopify, Lovable becomes the interface for running a SaaS business, they’ll be the thing SaaS founders log into from day one. I know this sounds like an impossible outcome given that Lovable currently gets stuck on simple errors, but would you believe this version of Shopify would be a $134B company?

Being the Shopify of SaaS is probably even bigger than being, well, Shopify, given that SaaS margins are high and the barriers are even lower if you don’t need to buy inventory, store products, etc.

It would open up a ton of monetization opportunities. Let’s walk through a few of them, starting with what Lovable already has.

Subscriptions

Lovable’s current pricing is extremely simple:

My suspicion is that pricing is simple because it’s easy to ship, not because it’s the perfectly optimized pricing strategy. As we’ve mentioned before, to sell a subscription, you need to provide ongoing value.

And it’s looking like people are starting to build real businesses on Lovable.

This means they’re creating ongoing value for their creators, which gives them a reason to stay on Lovable and justify the subscription and grow their business.

Could the next SaaS successes be built on an evolved version of Lovable, one with more options for human-in-the-loop coding and even better AI models? If so, its customers will stick around, paying their subscription for a long time—and probably buying add-ons.

Add-ons

I said above that founders could run SaaS businesses inside Lovable itself. I’m not saying Lovable will have everything a SaaS business could ever need.

But most SaaS apps work with dozens of vendors. You might have Okta for authentication, PostHog for analytics, Lago for complex billing, an in-app survey vendor… the list goes on.

Lovable is creating lots of new software founders who will eventually spend lots of money on vendors. That money will flow, but Lovable currently captures zero of it.

This is something the team can monetize. Let’s say Lovable sees users adding analytics to their apps. There are 3 ways to monetize this intent:

Add-ons: Lovable can build their own analytics product and sell it as an add-on for an additional monthly fee.

Partnerships: Lovable can partner with analytics vendors and get paid each time they refer a customer to them.

App store: Lovable can launch its own app store for builders to sell to Lovable’s customers and charge a fee per transaction.

All of these are viable ways to monetize something happening anyway. Lovable can do this for any category that users ask to be added to their product.

AI agents

This might sound futuristic, but a full app from a short sentence sounded futuristic last year, so hear me out. Most businesses eventually hire consultants or others to help out.

As AI agents grow more and more capable, I could imagine there being a market of AI agents created by the community. What if you could hire a Lenny Rachitsky product agent that analyzes what you’ve built so far, suggests options on what to build next and prompts Lovable for you to execute that plan?

It’s speculative of course, but I can imagine a type of “AI contractor marketplace” where creators compete. Lovable would be the ideal operator of such a marketplace because they have access not just to the entire codebase, but to the founder’s intents, the target market and everything else.

When operated like a marketplace, Lovable could earn a percentage of each time a founder “hires” one of the AI agents.

Another way to do this would be for Lovable to offer credits for these AI agents and pay out their creators by how much usage they’re getting, similar to YouTube paying out a percentage to creators.

Investing

“I’d love to build a way for founders to get everything you get out of Y Combinator inside Lovable … the marketing infrastructure, the entire playbook, even the company-formation setup, so founders can focus on product and users.”

That’s Anton Osika on the 20VC podcast. Floating this idea makes a lot of sense: Lovable is exposed to many early-stage ventures and could potentially invest in them (or empower founders to grow faster to use more on Lovable).

Services/miscellaneous

The hardest thing for Lovable is to keep being the destination they are and to become where people operate their software business. Shopify has a massive list of ways they monetize, including payments, developer APIs, influencer marketplaces—you name it.

If Lovable becomes the way people operate SaaS businesses, it can add a lot of other things. Because if building a product is easy, growth becomes hard—and Lovable can partner or build for those things.

But let’s get down to brass tacks.

Do they charge the right way?

Kyle Poyar reports from his interview with Lovable CEO Anton Osika:

True to form, Anton’s initial pricing philosophy was just ship.

That works. Overthinking monetization can become an obstacle when you’re finding product-market fit. Lovable’s current pricing is simple:

Lovable decided to give some free access to everyone and then charge a monthly subscription for more usage (starting at $20 per month).

That’s after the founder realized that “Lovable lost a shit-ton of money on the super active users”. Since then, AI usage consumes credits. If you run out, you can always buy more.

This is a typical way to protect your margins. Almost all AI companies do this to insure themselves against power users skyrocketing their AI bills.

Lovable’s current pricing is challenging the company because its billable metric is AI credits. But in a world where AI can build more and more autonomously, the core advantages become knowing what to build and how to distribute it.

That means Lovable’s customers will likely see front-loaded credit consumption, where they use Lovable to build their product, but then focus on getting users/customers.

Even later on, credit consumption is likely to be spiky when users work on new features rather than constant.

And if you’re sitting on unpaid credits every month, you might eventually feel like you’re wasting money. Maybe users don’t care as long as they’re making money on top of the platform.

But if a user pays for extra credits and never uses them, it could lead to frustration. A lever they can pull here:

Create a usage-based credit tier that includes 0 credits, but charges users a certain amount for each credit used (with cost control features to avoid surprise bills). The cost per credit should be higher than when bought in bulk with a subscription.

Another is progressive billing, which means not billing each bit of usage, but letting customers consume a certain amount of credits before they get a bill and then raising that threshold.

Next, Lovable should probably think about custom enterprise contracts. How many credits should be included in those? What if someone wants to self-host Lovable? Is it possible to create an unlimited deal?

If Lovable wants to sell to big customers, it needs to build enterprise features, but also offer flexibility. This will likely be hard. In non-AI SaaS, the more someone pays you, the better. In AI SaaS, it’s all about margin.

Finally, agencies using Lovable on behalf of clients could be massive multipliers. Even if agencies are not the main revenue driver, the agency’s clients’ integrations/payments etc. could become a lucrative business for Lovable.

But pricing isn’t just about how you create value. It’s also about your costs.

What are Lovable’s costs?

We’ve all heard that AI has marginal costs. The reason AI companies typically do credit pricing is because each bit of usage costs money.

When it comes to costs, it’s hard to know most things:

How many tokens a Lovable request typically consumes

Whether users consume all of their tokens or not

What margin Lovable charges on each credit

But Lovable reportedly only has 15ish people, so if the math works out, they may even be profitable.

Of course, there is competitive pressure to always be on the best models, which will be pricey.

What’s next for Lovable?

There’s a bunch of ways Lovable could go if they don’t go the Shopify-esque route. They could aim to disrupt more workflows. What if Lovable could live in a codebase and take on the easier Linear issues? What if it could live in Slack and a product manager can report simple issues Lovable automatically fixes?

That’s just one strategy that would require different monetization and product strategy. Whatever Lovable ends up doing, we’ll be watching.

This analysis is very much on point. I'm building a product in this space (https://getmocha.com), and can share a few more insider insights:

- The churn from companies like lovable is indeed very high, and user frustration is high also.

- There are sub-niches available. Building internal tools is not the same as landing pages is not the same as saas. In the previous website builder market, different players (webflow, squarespace, wix) found and dominated a sub-niche

- The market is way bigger than anyone realizes. Today hundreds of millions for basically early adopters and highly tech-savvy users. This tech can and will go mainstream

- A huge issue with lovable, solved by others like mocha and replit, is the app backend. Lovable took a shortcut and partnered with supabase but that deal will not last. Supabase is losing big on their free tier (had to raise 200M to support it) and both want to capture the margin from the customer. There will be a reckoning.

I built FormWise.ai

Something to just monetize a “prompt” since that’s the lowest hanging fruit for most users, particularly knowledge experts.

Most people get blank screen syndrome on what to actually articulate and create. It’s a problem of language and context.