It’s been more than 2 years since we last posted here. In 2022, we had just emerged from pivot hell—starting from scratch with a new product, new user discovery, new just about everything.

But 2 years in a startup is like 15 in real life, so a lot has changed since we last posted on here. We’ve tried a lot, shipped a lot of product and learned a lot (often via painful failure).

Those are a lot of lessons—and we’re reviving this Substack to share them more regularly. To start, let’s get you up to speed and share some lessons learned:

1. The team has grown (reluctantly, but steadily)

In early-stage startups, nothing matters as much as the team: One great hire can transform the company—and so can one bad hire. That’s why we’ve followed the typical YC advice of shooting for high talent density. We’d rather not hire than make a bad hire.

Today we’re 26 people. The talent density of the team is super high and everyone in the team trusts each other to do great work.

It’s a bit of a miracle that the core team stayed together through our hard pivot (though there were difficult conversations). But the challenges of a founding team are different than those we have now.

When there were just a few of us, all that mattered was making a dent in the mountain of work we faced. Now we also need to think about culture, management style, offsites, feedback cycles, hiring, etc.

2. We raised $22m

You may have seen this elsewhere, but we haven’t announced here yet that we’ve raised a total of $22m led by FirstMark.

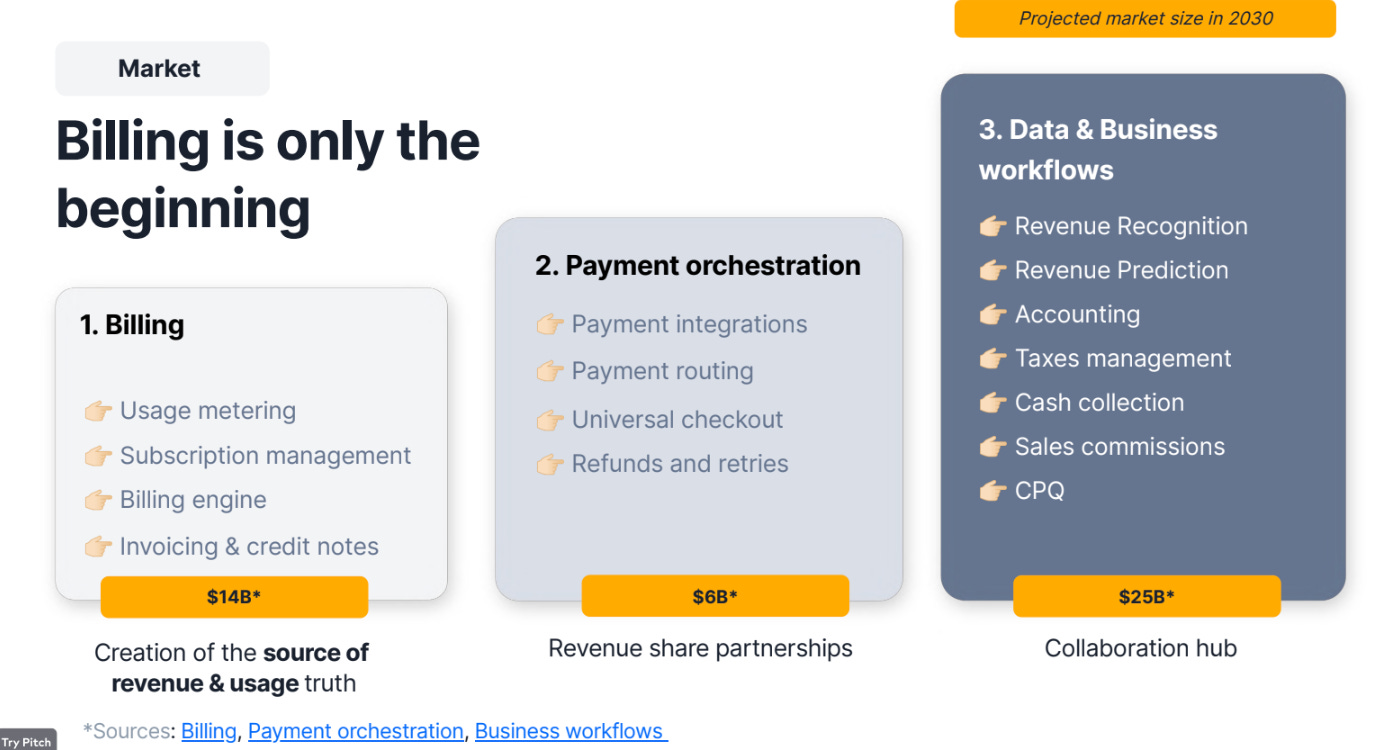

That’s because we realized the opportunity is massive. First, every company needs to bill its customers. We currently serve a small sliver of that market: Complex, usage-based billing. While even that opportunity is giant, our ambitions are bigger than that.

Because the billing system is the backbone for your company’s revenue, so there are a lot of complements we can eventually expand into. Or, as we put it in our pitch deck:

3. The best ideas come from your personal experience

When we knew it was time to pivot, we considered a ton of ideas, including trendy topics like a customer data platform for DAOs, a neobank for digital nomads, a type of Skillshare for people in startups…

All of these are “sexy” ideas. They sound great in a pitch deck. They make logical sense. And our moms could finally understand what we’re building here.

Instead, we landed on open-source billing APIs. An unsexy necessity no engineer or PM would volunteer to work on.

But we knew how often billing was the bottleneck at Qonto and how complex it is to build and maintain. This was an insight that was earned by painful experience.

One of our YC partners, Diana Hu, told us that she calls this the “grass is greener syndrome”: They want something else that’s not their previous career, so they don’t build in the space they’re deeply familiar with. They’re bored of the space or think their own experience isn’t unique. Ironically, it’s precisely the opposite. Anyone has access to the article that lists the 10 trendiest startup categories. Only you have access to your experience.

It’s usually those ideas that work best because you’re building based on an insight most others don’t have. So if you’re ever looking for a business idea, dive into your own experience, not into the current trends.

That’s just a few big picture lessons from the past few years. As we’ll publish more often on this Substack, you’ll hear more of the tactical lessons along the way.

Until then, check out what Lago is all about now—and book a demo if you don’t want to waste resources on billing.

Big fan of the pivot, and such a great point re: grass is always greener. Having such depth in fintech from Quonto is such an incredibly unique knowledge-set! Awesome to see you building the thing that is so painful to so many devs, in the billing space. It's needed for sure!